Table Of Content

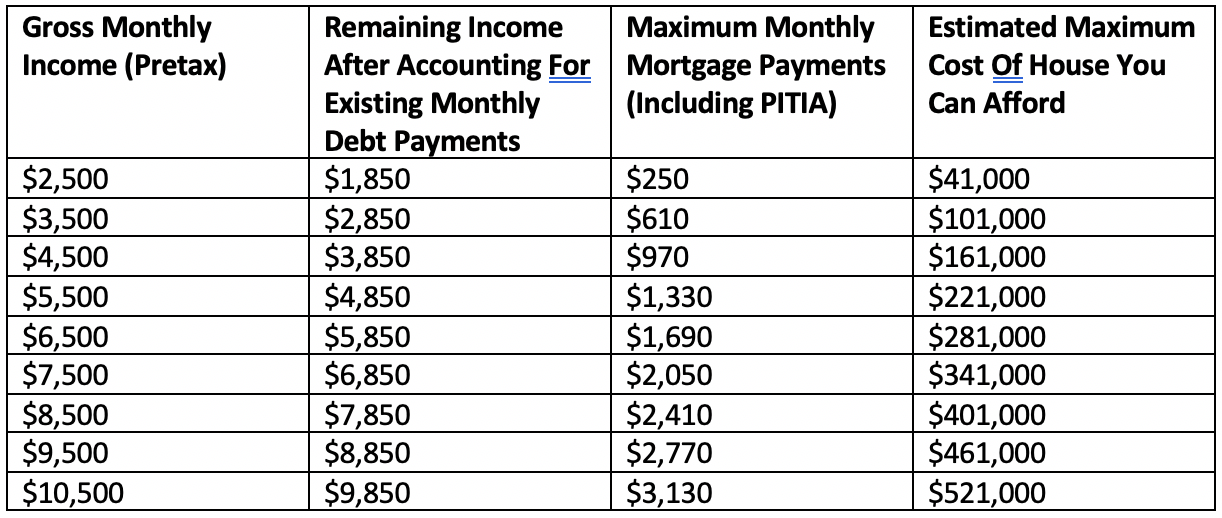

That’s why your pre-existing debt will affect how much home you qualify for when it comes to securing a mortgage. In order to avoid the scenario of buying a house you truly can’t afford, you’ll need to figure out a housing budget that makes sense for you. Results in no way indicate approval or financing of a mortgage loan. Contact a mortgage lender to understand your personalized financing options.

Account login

This is a significant slowdown compared when it peaked at 9.1% in 2022, but a slight uptick from the previous month's reading. We'll likely need to see more slowing before rates can drop substantially. It protects you from damage (for example, from fire) to your home or possessions.

Using the 36% Rule

If your score is 580 or higher, you could put down as little as 3.5 percent. In most areas in 2023, an FHA loan cannot exceed $472,030 for a single-family home. You’ll also need to factor in how mortgage insurance premiums — required on all FHA loans — will impact your payments. Lenders will also look at your debt-to-income ratio, or DTI, to get a clear picture of how risky it is to loan you money. Simply put, the higher your debt-to-income ratio, the more the lender will doubt your ability to pay the loan back.

Understanding down payments

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Real estate is land, or a parcel of land, either vacant (un-improved) or improved with structures such as a house, apartment building, commercial building, etc. Real estate, especially once it is thus “improved,” can serve as a place of business or residence and can be used to produce income, such as through renting or leasing.

Current FHA Loan Rates – Forbes Advisor - Mortgages - Forbes

Current FHA Loan Rates – Forbes Advisor - Mortgages.

Posted: Wed, 07 Jun 2023 17:47:40 GMT [source]

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you.

Property Taxes

You can slide the bar up to an “aggressive” 50% DTI ratio if you’re willing to make room in your budget for a higher payment. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate. Generally, the higher the credit score you have, the lower the interest rate you’ll qualify for and improve overall what you can afford in a home. Even lowering your interest rate by half a percent can save you thousands of dollars and increase your affordability range significantly. Where you live plays a major role in what you can spend on a house. For example, you’d be able to buy a much bigger piece of property in St. Louis than you could for the same price in San Francisco.

We'll help you estimate how much you can afford to spend on a home. Because they are used by lenders to assess the risk of lending to each home-buyer, home-buyers can strive to lower their DTI in order to not only be able to qualify for a mortgage, but for a favorable one. The lower the DTI, the more likely a home-buyer is to get a good deal. Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence.

Mortgages

There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. A lender is a financial institution that provides a loan directly to you. A conventional loan is a type of mortgage that is not insured or guaranteed by the government. If you cannot immediately afford the house you want, below are some steps that can be taken to increase house affordability, albeit with time and due diligence.

Factors that affect how much house you can afford

Sometimes the lender may agree to exceed the thresholds set out in this rule; for example, if you have an excellent credit score, you may receive a higher maximum debt-to-income ratio. No matter what your current financial situation is, our house affordability calculator will help you figure out what your future home could be. You can also use our tool as a simple mortgage affordability calculator.

Results exclude the 8 percent of non-homeowners who do not wish to own a home under any circumstances. An interest-only mortgage is a type of loan in which the borrower only pays interest on the principal balance for a set time, usually five to seven years. At the end of the interest-only period, the borrower must either pay the principal back entirely or begin making payments of both principal and interest. Interested in down payment assistance or grant programs for homebuyers with limited incomes? Learn about mortgages you might not have heard about, connect to mortgage loan officers and find answers to even more of your homebuying questions. If your credit scores aren’t high enough for you to get the rates you’d like, you may choose to work on raising your scores before shopping for a home.

→ The 28 is a recommended DTI ratio for your monthly mortgage payment compared to your gross monthly income. Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. Most home loans require at least 3% of the price of the home as a down payment.

No comments:

Post a Comment